Capabilities

Empowering field operations with smart, efficient, and data-driven solutions.

PIN Code Partners

Unlock detailed insights with PIN Code Parameters!

We partner for success

Assign the loan account to the Field Officer (FOS) who is closest to the customer's location, ensuring efficient proximity-based management. Allocate accounts to resources available within the respective pin code areas to optimize coverage. Additionally, arrange visits to any new address provided by the customer or updated by the skip tracing team, ensuring all leads are thoroughly followed up.

Digital Payments

Collect / Deposit & online BRS

Payments

- Digital Receipting

- Receipting in offline mode

- Track delay in deposition / rotation of cash

Auto Reconciliation

- BRS has been fully automated for all the payments of the organization

- Reconciliation of the proof of the payment collected by the FOS is just a click away

Geo Location

Enjoy real-time, live tracking with instant updates!

- Live Tracking

- Retrieve the History

- Automate the route map

- New joiners no need to worry, this module will lead you to the address of the customer, which was visited by your predecessor

- FOS can plan and accordingly prioritize the visits

Settlement & Closure

ML driven, Board approved waiver matrix specific to Loan Product and Bucket is applied

Waiver & Settlement

- Entire process of waiver and settlement is automated

- Settlement letter for approved accounts are sent automatically, along with the payment links

- Integration with CIBIL for instant update

Online Settlement / Closure

- Online settlement and closure without human intervention in fully automated environment

- 100% adherence to the Board approved Settlement / Closure waiver matrix

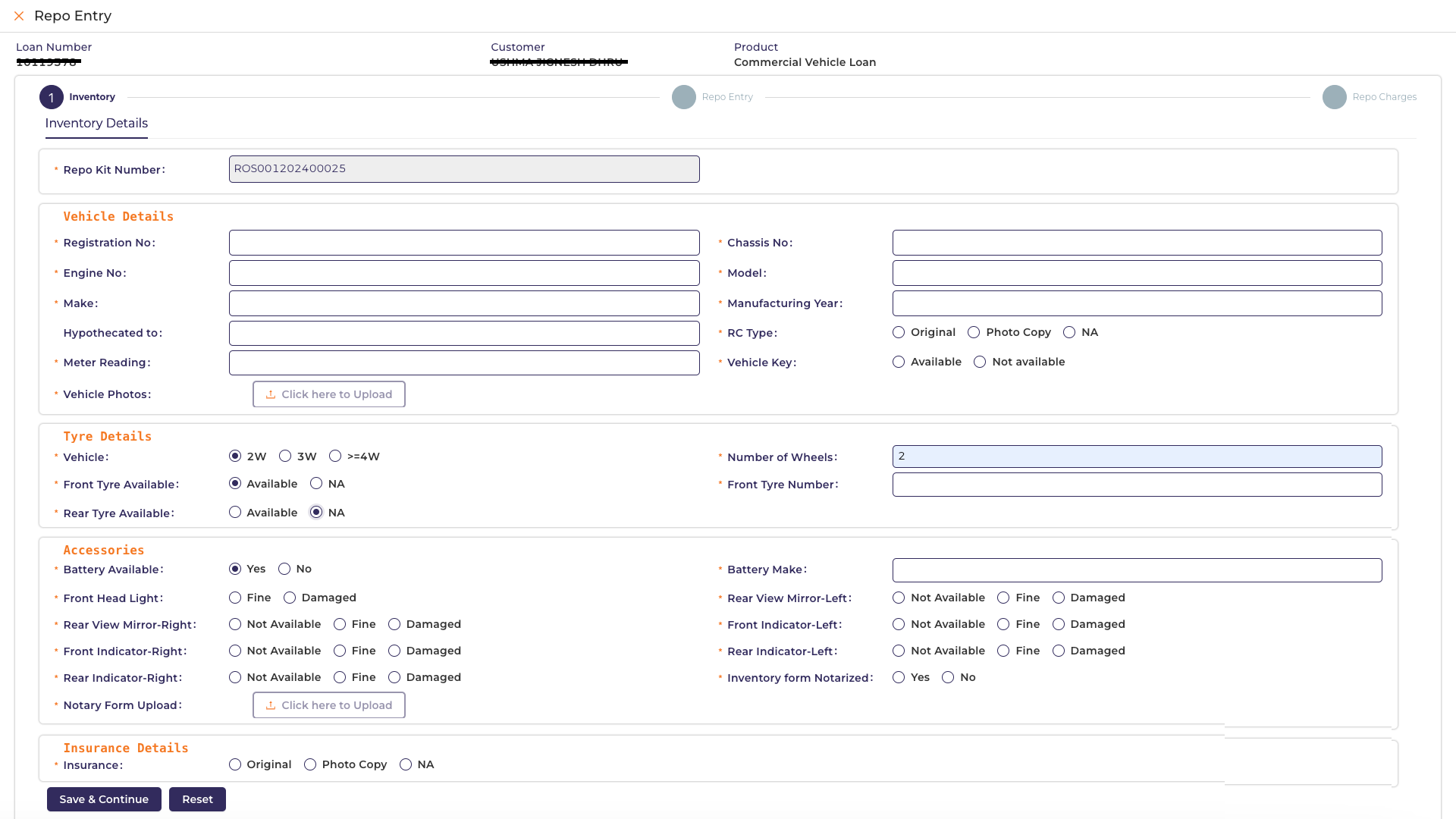

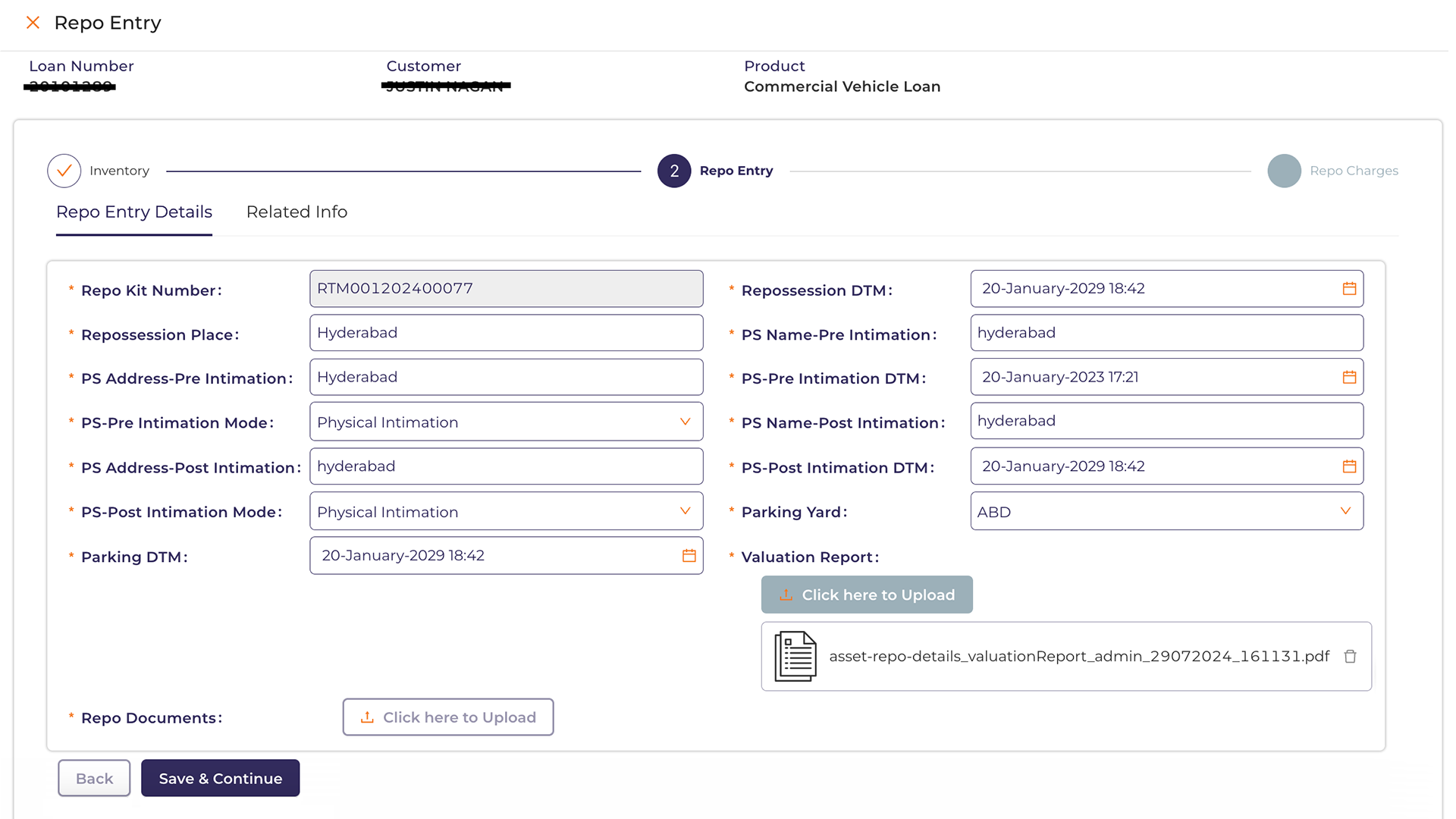

Repossession

Fully Digitized the repo module for Housing Loan, Commercial Vehicle Loan, LAP, Two Wheeler Loan, Car Loan, Plant & Machinery etc.

- First of its kind that the entire repo process from repo approval to issuance of the repo kit, to Pre & the post intimation to Inventory to parking of the vehicle in the yard to part payment release has been digitized

- Automatically process the invoice of the repossession agency strictly as per preapproved repo charges grid

- Assign the repossession activity to the nearest available repossession agent, whether interstate, interdistrict, or across multiple states. Track the validity and any cancellations of the repossession kit online

- Complete Audit trail for internal and the external Audit team

- Track, approve or reject the auction eligibility request

Campaign Management

Maximize engagement, optimize results.

- Multichannel campaigns in vernacular language

- Effortlessly run multichannel campaign viz WhatsApp, email, text message

- Real time campaign dashboard for insights, tracking and corrective steps

Legal

Track and manage the legal cases by centralizing or decentralizing the workflow as per the requirement of the organization

- Access to the local lawyers for updating and tracking the cases of any loan products

- Send and track the legal communication in vernacular language in automated environment

- No need to do manual mail merge, no need to attach the document separately in each mail

- Upload the template, email or WhatsApp lakhs of dunning letters, Notices, reminders overnight

- Live tracking of notices sent by WhatsApp, summary report of delivery status, blue tick etc

- Auto reminders to the lawyer & the legal Manager before the date of hearing

- Upload all the documents related to the case filed in the court

- Track the legal case at every stage through the lawyer who is handling the case

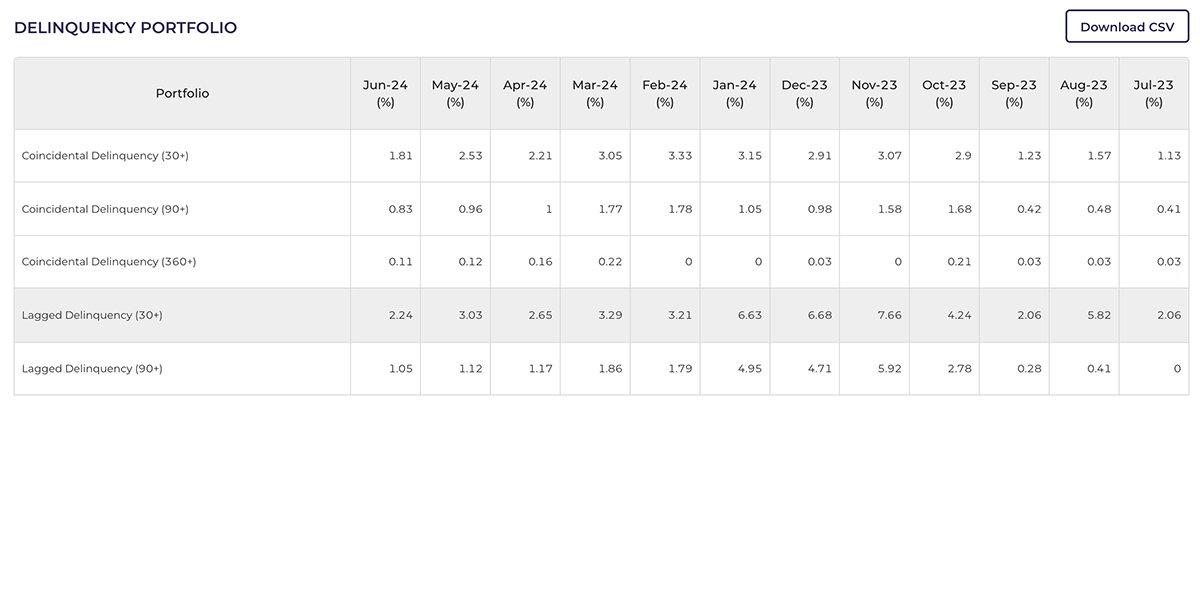

Data Visualization

Numerous algorithms put life to multiple layers of the cluttered information

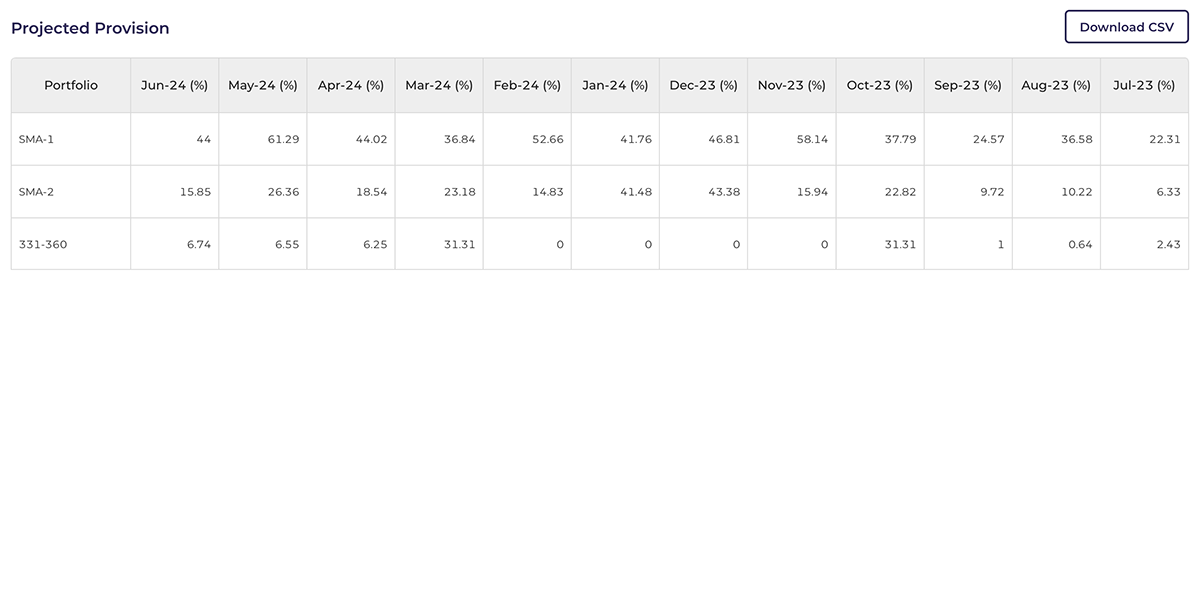

Strategic Dashboard

- PAR (Portfolio at Risk) forecast across hierarchy, to avoid additional provisioning

- Automatically predicts the flow forward for case specific approach

- Product wise / bucket wise live dashboard for monitoring Credit Loss

- Devise roll back strategy for any product / bucket

- Early warning signal for critical execution

- Contributes in adding to the bottom line of the organization

- Detection of fraud, enhancing the compliance and adherence of the process is made easy

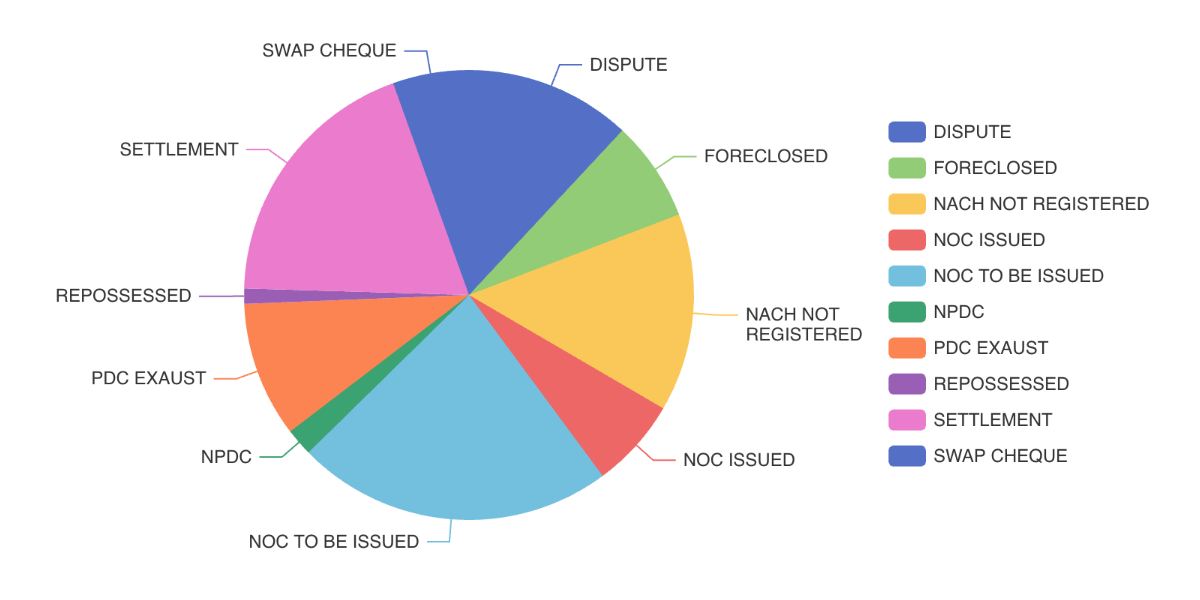

- ML models seamlessly categorise the portfolios for effective planning and execution

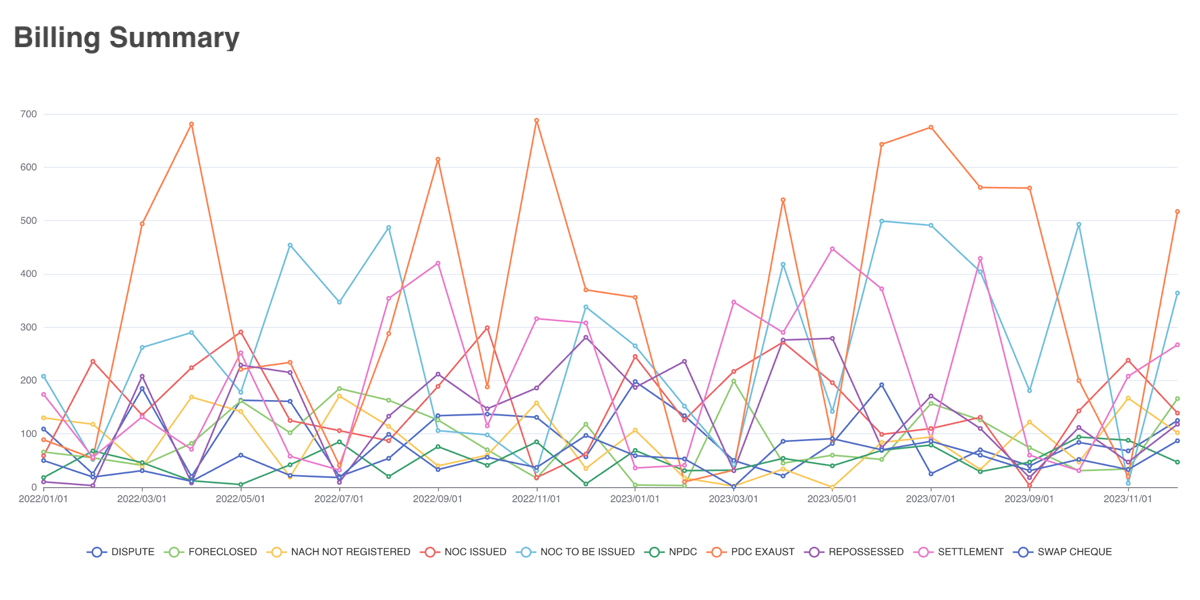

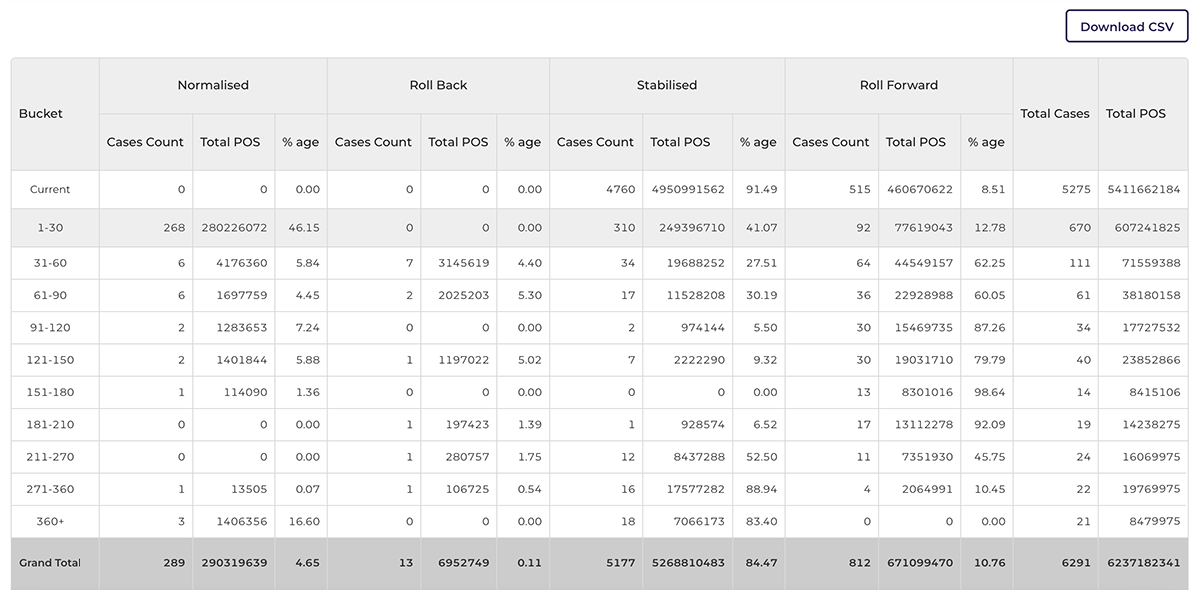

Performance Dashboard

- Roll Back, Roll Forward, Stabilisation, Normalisation (Roll Rates) are live for all the loan products

- Tele-caller / FOS performance report

- PTP: Payment Collected vs Broken PTP MIS

- Milestone Target vs Achievement

- Recovery from Written-off accounts vs Achievement

- POS release MIS

- Collections from matured cases / Collections from Charges

- Reports are fully automated from Field staff to CXO

Allocation

Optimize resource allocation with real-time insights and streamlined team management

Tele-calling

Action begins here

- Tele-Calling: Manage tele-calling campaign, be it legal counselling, cheque bounce intimation, pre due call etc

- Related Info: Get the insight of past feedback, overdue, asset, loan details etc for effective calling

- New info comes handy for effective counselling and calling

- Calls Review / Visit Review: Round the clock the supervisor can review the performance of the team

- Paid File: Any mode of digital payment either from Google Pay, Phonepe, PayTm etc is reconciled live

- Escalation: Proactively resolve the service issues raised by the customer at the initial stage itself and add value to the brand image of your organisation

- Holiday Management: State specific holidays to schedule the visits, calls and meetings

Field Follow-up

- Mobile App available in vernacular language

- Update the feedback live, attach the photographs

- Auto allocate pick-ups, PTP for field follow-up

- 3rd party details who has the vehicle can be updated for future follow-up

- Raise receipt in offline mode

- Update the details of the PDC collected for future EMI or PDC collected towards settlement in tranches

Valuation of the Asset

Valuation of the movable asset, immovable asset, plant & machinery is just a click away

- On board empaneled valuer even in Tier - 2 and above cities

- Track the movement of the valuer to the spot of the asset

- Auto reminder of the validity of the valuation report

- Upload document, photographs directly in the server

FI, PDFI & TVR

Digitised Field Investigation and Tele Verification

- Onboard FI agencies in talukas also

- Conduct Tele verification for office & Residence

- Conduct Post-delivery FI of the asset